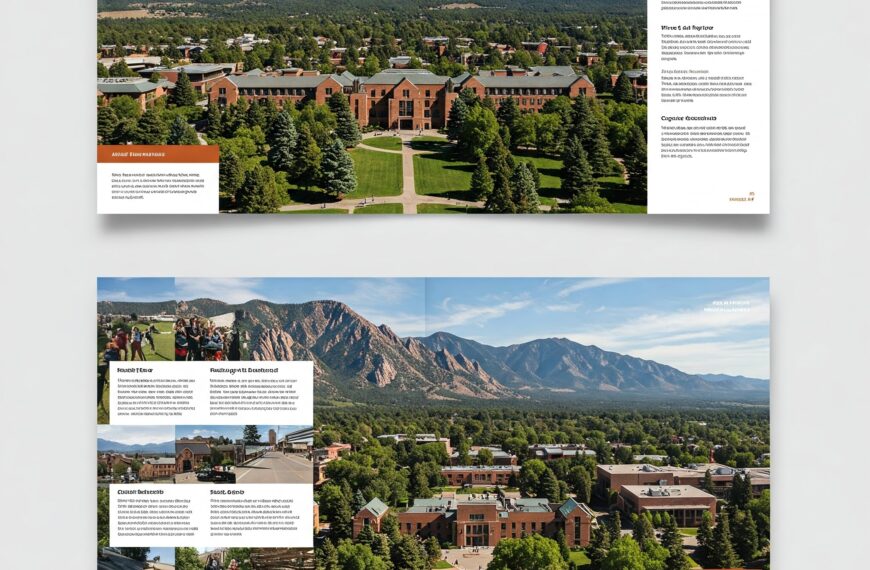

A comprehensive guide to financing your education at the University of Rhode Island

Navigating the world of student loans can be overwhelming, especially for URI students facing the average annual cost of $31,686 (in-state) or $49,546 (out-of-state). This comprehensive guide breaks down your best financing options, from federal loans to private alternatives, helping you make informed decisions about your educational investment at the University of Rhode Island.

With over 14,000 undergraduate students enrolled at URI, understanding your financial aid options is crucial for making your college dreams a reality. Whether you’re an incoming freshman, transfer student, or continuing your education, this guide will help you navigate the complex world of student loans and financial aid.

Average Aid Package

$15,892 per year

Including grants, scholarships, and loans

Students Receiving Aid

92% of undergraduates

Based on 2023-24 academic year data

Graduation Rate

69% within 6 years

Higher than national average of 63%

Understanding URI Costs (2024-25)

In-State Students

- Tuition$15,942

- Room & Board$13,244

- Books & Supplies$1,200

- Other Expenses$1,300

- Total Cost$31,686

Out-of-State Students

- Tuition$33,802

- Room & Board$13,244

- Books & Supplies$1,200

- Other Expenses$1,300

- Total Cost$49,546

Note: Costs are based on the 2024-25 academic year. Additional fees may apply depending on your program of study.

Federal Student Loan Options

Federal student loans should be your first consideration when borrowing for college. They offer more benefits, flexible repayment options, and generally lower interest rates compared to private loans.

- Direct Subsidized LoansAvailable to undergraduate students with demonstrated financial need. Interest is paid by the government while you’re in school.

- Interest Rate (2023-24): 5.50%

- First-year borrowing limit: $3,500

- No credit check required

- 6-month grace period after graduation

- Direct Unsubsidized LoansAvailable regardless of financial need. Interest accrues while you’re in school.

- Interest Rate (2023-24): 5.50%

- First-year borrowing limit: $5,500 (minus any subsidized amount)

- No credit check required

- Interest accrues during school

- Parent PLUS LoansAvailable to parents of dependent undergraduate students to help pay for education expenses.

- Interest Rate (2023-24): 8.05%

- Can borrow up to the full cost of attendance

- Credit check required

- Repayment begins immediately

URI-Specific Financial Aid Programs

URI offers several institutional aid programs to help make education more affordable. These programs are specifically designed to support both in-state and out-of-state students based on merit and need.

Merit-Based Programs

- URI Merit ScholarshipsAvailable to incoming freshmen with strong academic recordsAwards up to $15,000 per year

- Centennial ScholarshipsMerit-based awards for out-of-state studentsAwards up to $20,000 per year

Need-Based Programs

- URI GrantNeed-based assistance for qualifying studentsAward amounts vary based on need

- Work-Study ProgramsFederal and institutional opportunities availableAverage award: $2,000 per year

Private Student Loan Options

Private student loans should typically be considered only after exhausting federal loan options. These loans are offered by banks, credit unions, and other financial institutions, with terms varying by lender.

URI’s Preferred Lenders

While URI doesn’t endorse specific lenders, these institutions have historically provided competitive rates and quality service to URI students:

- Sallie Mae

- Discover Student Loans

- College Ave Student Loans

Key Considerations

- Interest rates typically range from 4.5% to 13.5% based on credit score

- Most private loans require a creditworthy cosigner

- Repayment terms vary from 5 to 15 years

- Compare multiple lenders to find the best rates and terms

Frequently Asked Questions

When should I apply for financial aid at URI?

Submit your FAFSA as early as October 1st. URI’s priority deadline is February 1st. Early application is crucial as some aid programs have limited funding and are awarded on a first-come, first-served basis.

What is URI’s FAFSA code?

URI’s Federal School Code is 003414. You’ll need this code when completing your FAFSA to ensure your information is sent to URI’s Financial Aid Office.

Can international students get loans?

International students aren’t eligible for federal loans but may qualify for private loans with a U.S. co-signer. URI also offers some merit-based scholarships for international students.

How do I accept my financial aid offer?

Log into your e-Campus account and navigate to the Financial Aid section to accept or decline awards. Make sure to complete all required documentation and entrance counseling for loans.

Are there payment plans available?

Yes, URI offers monthly payment plans through Nelnet Campus Commerce. These plans allow you to spread your payments over 5 months each semester, with no interest charges.

What GPA do I need to maintain financial aid?

Students must maintain a 2.0 GPA and complete 67% of attempted credits to maintain Satisfactory Academic Progress (SAP) for financial aid eligibility.

Can I appeal my financial aid decision?

Yes, appeals can be submitted to the Financial Aid Office with supporting documentation. Common appeal reasons include changes in family income, medical expenses, or other special circumstances.

Financial Aid Timeline

October 1st

FAFSA becomes available for the next academic year

February 1st

URI priority deadline for FAFSA submission

March-April

Financial aid award letters sent to students

May 1st

Deadline to accept/decline financial aid offers

Ready to Start Your URI Journey?

Contact URI’s Financial Aid Office for personalized assistance with your student loan options.

📞 Phone: (401) 874-9500

📧 Email: financialaid@uri.edu

🏢 Office: Green Hall, 35 Campus Avenue

Office Hours: Monday-Friday, 8:30 AM – 4:30 PM EST

I’m really impressed with your writing abilities and also with the format on your blog.

Is that this a paid theme or did you modify it your self?

Either way keep up the nice high quality writing, it is uncommon to

look a nice weblog like this one today. Stan Store!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.